- STARTUPS

- STARTUP BUILDING

- EVOLUTER ACCELERATOR

- RESOURCES

- …

- STARTUPS

- STARTUP BUILDING

- EVOLUTER ACCELERATOR

- RESOURCES

- STARTUPS

- STARTUP BUILDING

- EVOLUTER ACCELERATOR

- RESOURCES

- …

- STARTUPS

- STARTUP BUILDING

- EVOLUTER ACCELERATOR

- RESOURCES

Ergodic Investing

Introduction, for investors, next gen, and their advisers, to the hidden strategy that outperforms in times of uncertainty and risk. The strategy underpinning the new and old success stories: the Universa hedge fund, Hanseatic merchants, Japanese Keiretsu, and nature.

Can you do a better job protecting and growing your money?

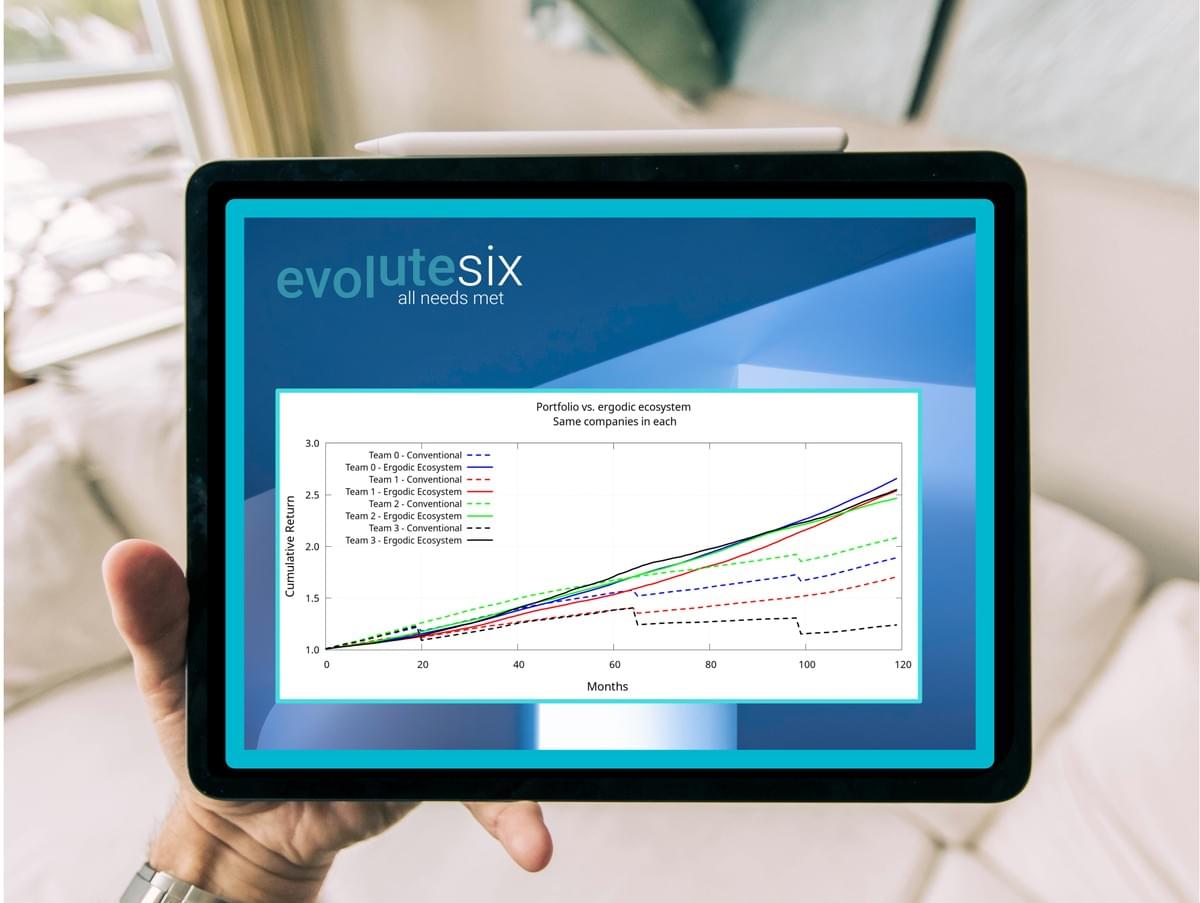

Click play and compare

the performance of 4 different portfolios over ten years

vs. the same companies invested as an ergodic ecosystem.

How confident are you,

that your current investment strategy will do better protecting and growing your money in our ever more unpredictable and volatile future?

When all you can be sure of is ever more unpredictability and volatility.

It's time for VCs, LPs, and asset managers to use the recently understood and perculiarly named ergodic strategy that the Universa hedge fund (Spitznagel and Taleb), the Mondragon group, Japanese Keiretsu and Korean Chaebol, and long-lasting old cultures evolved towards. Because those that didn't went under during VUCA times.

With over 100 years of experience between us in investing, economics, complexity, and innovation, we are developing the software you need to use the counter-intuitive ergodic investment strategy; the strategy designed for uncertainty and volatility.

Oh, and it really wins if you also have an impact or regenerative intent!

But don't take our word for it: experience the difference in this challenge, a simplified version of our investment simulator.

Ergodic thinking shines a light on the path to a prosperous future by aligning our finance with the complexity of how all living systems actually work: in dynamic balance, collaboratively.

John Fullerton, Capital Institute

A breakthrough strategy of investing based on a key element of anti-fragility. The take-aways are significant and possibly solve the scaling issue that perplexes the regenerative community. The method takes cues from nature and is proven with mathematics.

Lyn McDonell President, The Accountability Group, Inc.

Stop suffering inefficient and hidden capital losses. Highly recommended read.

Antonio Potenza; FRSA, MBA Oxford, CISL Cambridge, Founder of Proodos Capital and Fund4Impact, Serial Entrepreneur

Get a head start

Contact us for a custom programme for your firm

or secure your place on our next open programme below

Ergodic Investment Strategies

1.499,00 €

Early bird rates for the next 5-week course for investors and fund allocators to get the best in our complex, uncertain world by deploying ergodic investment strategies. Why they work better in complex uncertain times, how they work, and how to use the full version of our simulator. On 5, 12, 19, 26 September and 3 October 17:00 - 19:00 Brussels time.

Max. 4 companies or 8 people (whichever comes first) courseView more details...QuantityComing soonMeet the trainers

Graham Boyd (Founder Evolutesix)

Graham is the founder of Evolutesix, a venture studio and investor specialised in building ecosystems of future-fit businesses according to Evolutesix's ergodic investment strategy.

Author of The Ergodic Investor and Entrepreneur and Rebuild: the Economy, Leadership, and You, leading guide books for investors and entrepreneurs to create successful businesses for the future.

With a PhD in physics, he is at his best creating new opportunities for success in volatile, uncertain times. His speciality, according to his colleagues, has always been breakthrough innovation because he sees far round corners others cannot yet see.

Greg Fisher

Greg has a strong background in economics and asset management, which he recently supplemented by finishing a PhD in the advanced field of Complexity Science. His aim now is to leverage this understanding, and his skills in computational modelling, to help improve practice in banking and asset management.

Greg is an asset management and complexity science expert with a distinguished background, including a PhD in complexity economics, CFA, staff at the Bank of England, Chief Strategist at a macro hedge fund, and Cambridge University graduate.

His speciality, complexity science, is a new way of thinking that is relevant to investment management and banking.

© 2023