- RESOURCES

- …

- RESOURCES

- RESOURCES

- …

- RESOURCES

be a systemic impact investor

How certain are you that your investment theory is the best you can do?

If you're certain, close the tab.

But if you're not certain, especially if you're investing for the long term of your family office; if you aim for impact as well as capital preservation and growth; if you want to leave a legacy; and / or if you know that we need systems change; then read on.

Let's talk about how our systemic approach works better. Then choose what's right for you. Perhaps bespoke consulting just for you, or one of our public trainings, such as the investor introduction, or the 12 month MBA level practitioner training. The 12 month practioner training will get you enough to begin to use complexity and ergodicity to deliver systemic investing, which is beginning to replace conventional portfolio investing because it performs better in VUCA times.

Are you disillusioned about the VC current model, about chasing unicorns, needlessly high startup failures? There is a better way, grounded in absolutely solid mathematics. More solid than portfolio theory ...

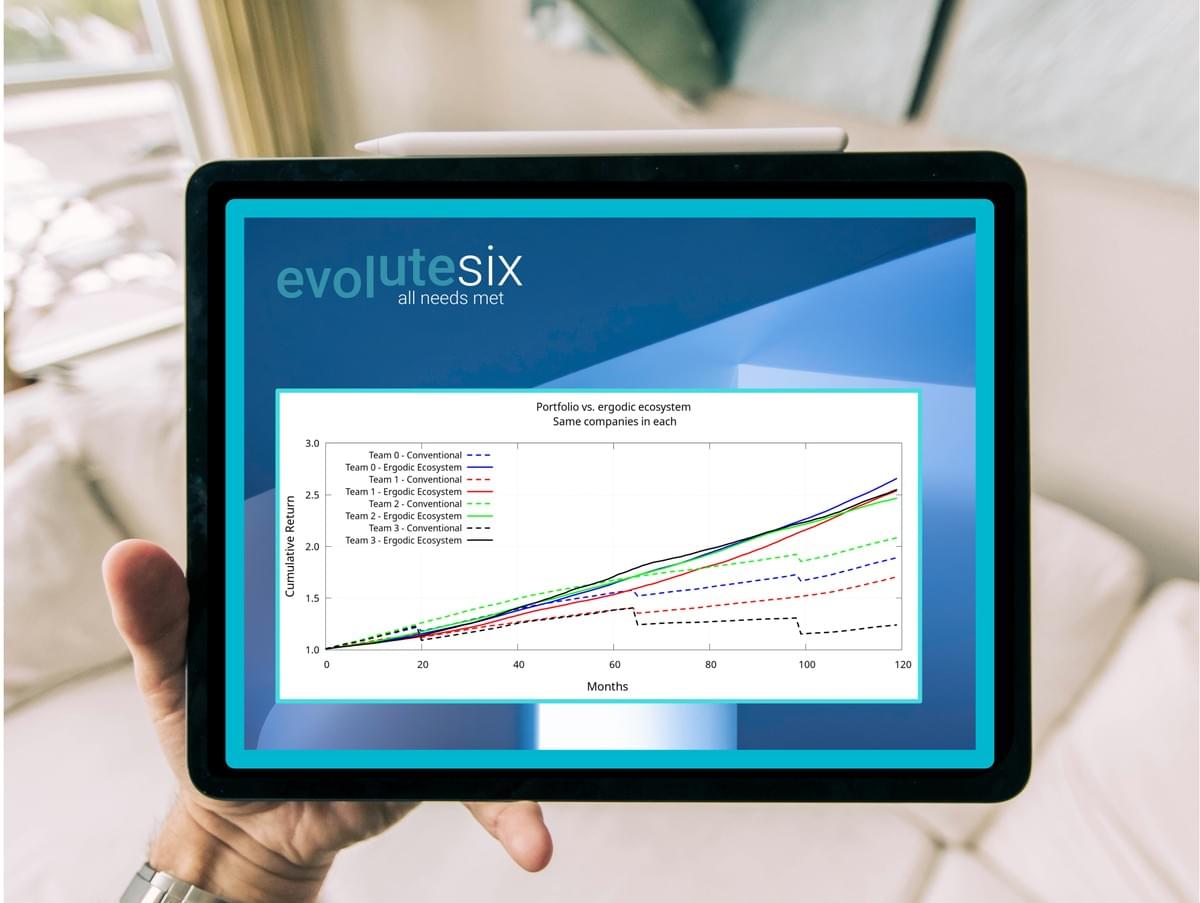

Click play to compare

the performance over ten years of 4 different conventional portfolios (dashed lines) vs. the same companies invested in according to ergodic investing (solid line). This is from our planning software, not historical data. Watch minutes 10:28 to 14 of the discussion between Graham and Robert Rubinstein of TBLI for the comparison.

It's time for all FO, VCs, LPs, and their professional managers to use the recently named and statistically understood, but historically dominant, ergodic investment strategy. Otherwise we're going to continue to waste money and lose valuable time in trying to close the triad of impact, preservation, and growth of capital. The Universa hedge fund (Spitznagel and Taleb), the Mondragon group, Japanese Keiretsu and Korean Chaebol, and all long-lasting old cultures used this strategy; ergodic investing is the future.

You will get

- The solutions to a little-known root cause of capital losses: non-ergodic capital growth processes.

- Harnessing complexity and uncertainty for benefit.

- The vital difference between uncertainty and risk.

- A better way for family offices of aligning the interests of principals and the KPIs of the wealth allocators.

- See, in the face of ever more uncertainty, new options for success.

Further details in the course outlines and in the FAQ below.

Ergodic thinking shines a light on the path to a prosperous future by aligning our finance with the complexity of how all living systems actually work: in dynamic balance, collaboratively.

John Fullerton, Capital Institute

A breakthrough strategy of investing based on a key element of anti-fragility. The take-aways are significant and possibly solve the scaling issue that perplexes the regenerative community. The method takes cues from nature and is proven with mathematics.

Lyn McDonell President, The Accountability Group, Inc.

Stop suffering inefficient and hidden capital losses.

Antonio Potenza; FRSA, MBA Oxford, CISL Cambridge, Founder of Proodos Capital and Fund4Impact, Serial Entrepreneur

Who this is for, what do you get, FAQs

Who else is already using ergodic strategies?

Why is it so little known and used by investors?

Flip the 95% of VC funds underperforming for LPs

Align FO principals and their professional asset managers

Does this help me use the strength of VC meaningfully, e.g. climate change?

Does this resolve the 'either profit or impact' tradeoff?

Is this relevant for regenerative investing?

The future will not be more of the past.

How this enables you to deliver bigger impact and systemic impact.

How does this address equity and the historically overlooked / excluded?

Wishing you could invest in game-changing ideas?

Looking for a way of eliminating the waste in investing?

Is this relevant to pension fund managers?

What is the difference between uncertainty and risk?

What does this have to do with Russian Roulette?

Meet the trainers

Graham Boyd (Founder Evolutesix)

Graham is the founder of Evolutesix, a venture studio and investor specialised in building ecosystems of future-fit businesses according to Evolutesix's ergodic investment strategy.

Author of The Ergodic Investor and Entrepreneur and Rebuild: the Economy, Leadership, and You, leading guide books for investors and entrepreneurs to create successful businesses for the future.

Previous startups founded or co-founded include SUNthing (renewable energy), Renaissance2 (new economy think tank), and TetraLD (leadership development).

With a PhD in physics, he is at his best creating new opportunities for success in volatile, uncertain times. His speciality, according to his colleagues, has always been breakthrough innovation because he sees far round corners others cannot yet see.

Greg Fisher

Greg has a strong background in economics and asset management, which he recently supplemented by finishing a PhD in the advanced field of Complexity Science. His aim now is to leverage this understanding, and his skills in computational modelling, to help improve practice in banking and asset management.

Greg is an asset management and complexity science expert with a distinguished background, including a PhD in complexity economics, CFA, staff at the Bank of England, Chief Strategist at a macro hedge fund, and Cambridge University graduate.

His speciality, complexity science, is a new way of thinking that is relevant to investment management and banking.

© 2023